The Ohio General Assembly has established a program whereby Ohioans can receive a 100% tax credit against Ohio income tax liability for cash contributions to certified organizations that grant scholarships to students (scholarship granting organizations, or SGOs). CHESS Christian School is part of the Ohio Christian Education Network (OCEN), which has created its own SGO. Scholarship priority is given to low-income families.

The maximum credit amount is currently $750 for individuals and $1,500 for married couples filing jointly. Should a taxpayer donate more than the taxpayer’s income tax liability, the credit will reduce the taxpayer’s liability to zero (it will not create a refund).

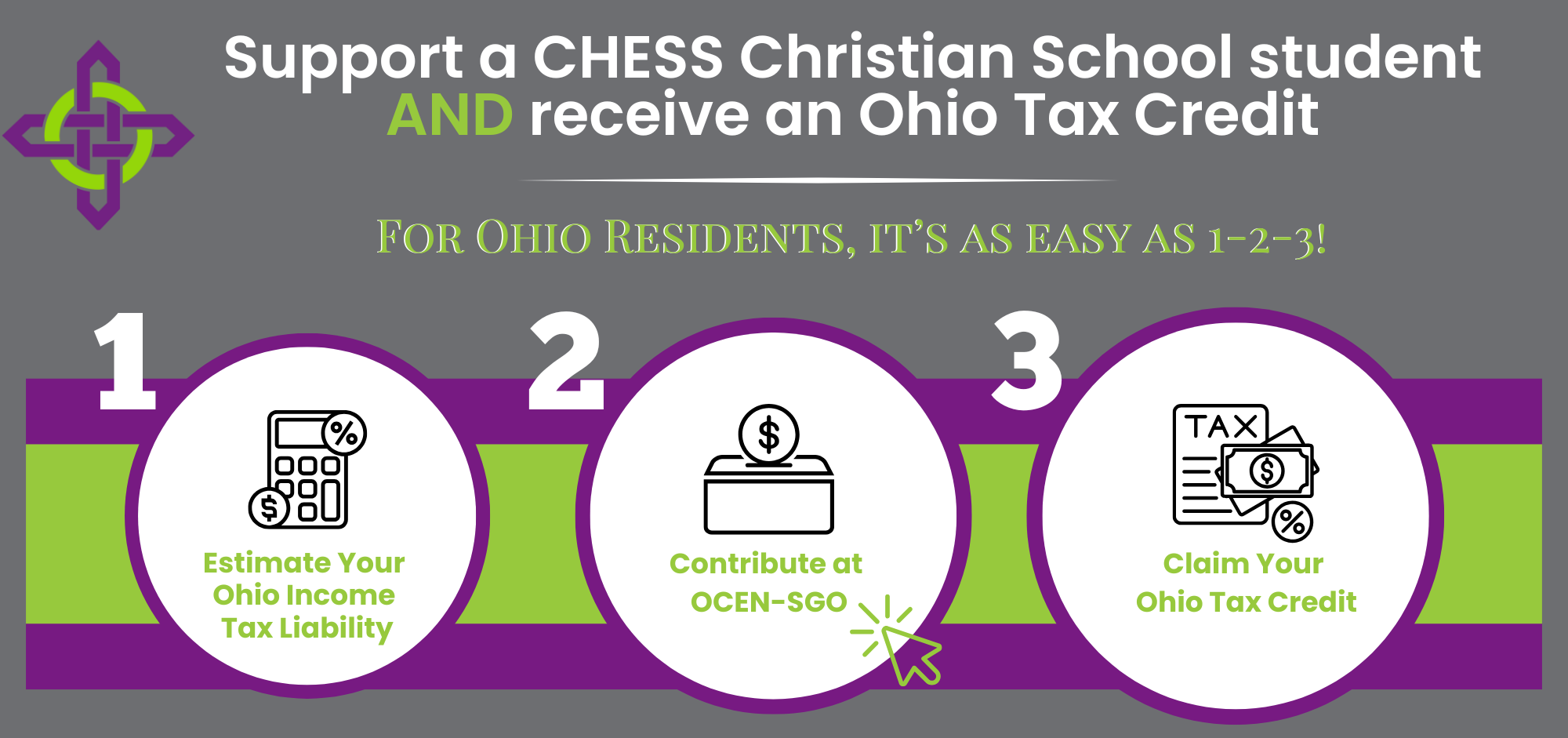

Here is how to take advantage of the program and support CHESS Christian School in the process:

- Go to the OCEN Website (www.ocen.org)

- Choose CHESS Christian School under “Select Schools”

- Complete the payment with your credit card

You will receive a tax acknowledgment from OCEN, which you will need for your Ohio state tax return.

It is important to note that this is a way to redirect your tax dollars – this is not a philanthropic donation. If you have questions, be sure to consult your accountant.

What is a scholarship granting organization (SGO)?

Scholarship Granting Organizations are separate, tax-exempt, 501(c)3 organizations. SGOs are established to collect donations on behalf of participating schools who want to provide scholarships to their eligible students. Each SGO and their participating schools determine the scholarship application and subsequent award process according to Ohio laws and guidelines.

What is the benefit of an SGO?

Only donations made to a certified scholarship granting organization (SGO) are eligible to receive a tax credit on an individual’s state of Ohio tax return. The state of Ohio recently enacted legislation allowing a tax credit up to $750 per individual or $1,500 for married couples filing jointly for donations made to certified scholarship granting organizations. This credit is available to individuals who have an Ohio tax liability.

How does a tax deduction differ from a tax credit?

A tax deduction reduces a taxpayer’s overall taxable income. A tax credit is a dollar-for-dollar credit against the taxes paid to the state of Ohio up to the limits allowed by the credit. All SGO donations are directed to the Ohio Christian Education Network and earmarked for CHESS Christian School rather than to the state.

How do I support CHESS Christian School?

CHESS Christian School is part of the Ohio Christian Education Network (OCEN), which has created its own SGO. This allows donors to make donations for our students while also receiving eligibility for tax credits.

This is not a charitable donation, but, rather, a way to reduce your state of Ohio tax bill. In the simplest form, you can choose to pay the state of Ohio or help a CHESS student. We see it as a win-win…reducing your tax liability, while helping a CHESS student.

How can I participate?

- Go to the OCEN Website (www.ocen.org)

- Choose CHESS Christian School under “Select Schools”

- Complete the payment with your credit card

You will receive a tax acknowledgment from OCEN, which you will need for your Ohio state tax return.

CHESS Christian School

CHESS Christian School